The UK tax system is a myriad of different tax rates, allowances and relief schemes that aim to provide a fair playing field to everyone who earns money in the UK, whilst ensuring that enough capital is brought in to support the economy. The amount that you pay and are entitled to depend not only on how much you earn, but how you earn it. For example, there are different tax rules for self-employed workers compared to employed workers, and for sole traders compared to limited companies. It’s a complicated mix, which is why we have pulled out the need-to-know information for the 2022-2023 tax year, focussing on:

-

Tax Thresholds

-

National Insurance Thresholds

-

Statutory Payments Increases

-

Student Loan Thresholds

National Minimum Wage Hourly Rates

* Note: Rates, Allowances & Thresholds differ in Scotland to the rest of the UK. See tax rates in Scotland.

When do tax rates change?

With every new tax year, the government introduce a set of changes to rates, allowances and thresholds in their annual Budget announcement. The tax year runs from 6th April until 5th April the following year and all changes remain in place for the duration of the tax year.

It is unusual for any changes to be made midway through a tax year, but unprecedented circumstances such as the Covid pandemic have seen emergency measures introduced at a later date. In 2022/23, the National Insurance Primary Threshold will increase during the tax year.

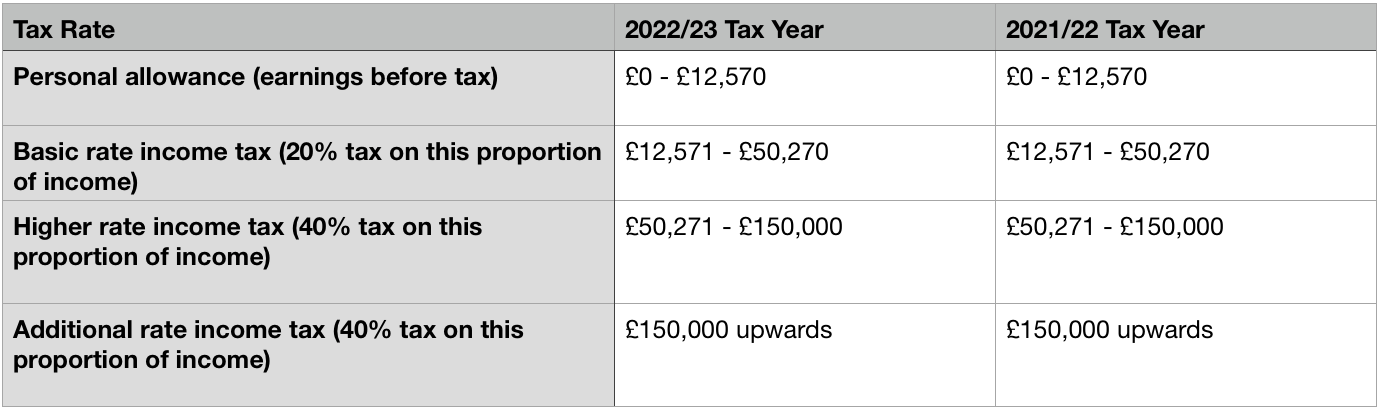

Tax Thresholds

All tax thresholds and allowances remain the same as last tax year. The standard tax code remains

1257L.

Higher rate income tax (40% tax on this proportion of income)

£50,271 – £150,000

£50,271 – £150,000

Additional rate income tax (40% tax on this proportion of income)

£150,000 upwards

£150,000 upwards

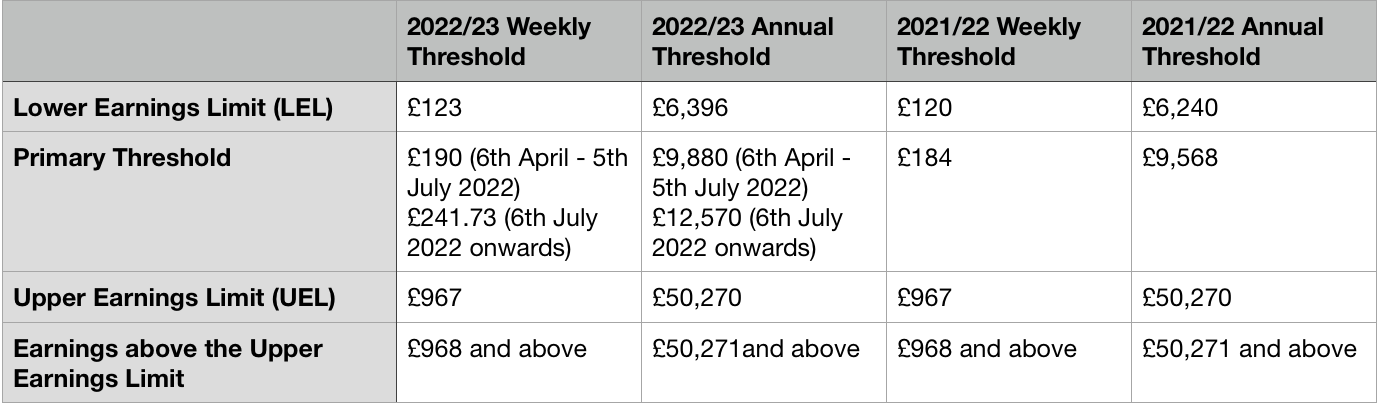

National Insurance Thresholds

There have been changes to 2022/23 Class 1 (primary) National Insurance thresholds and rates for employees.

Employees

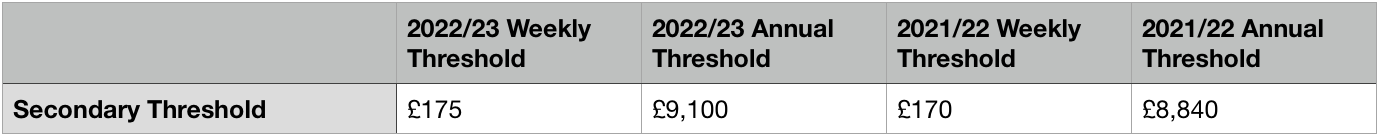

There have also been changes to 2022/23 Class 1 (secondary) National Insurance thresholds and

rates for employers.

Employers

A new health and social care levy begins in April 2022. This will cause an increase in National Insurance by 1.25% for both employees and employers.

- Employees: 12% to 13.25%

- Employers 13.8% to 15.05% for employers

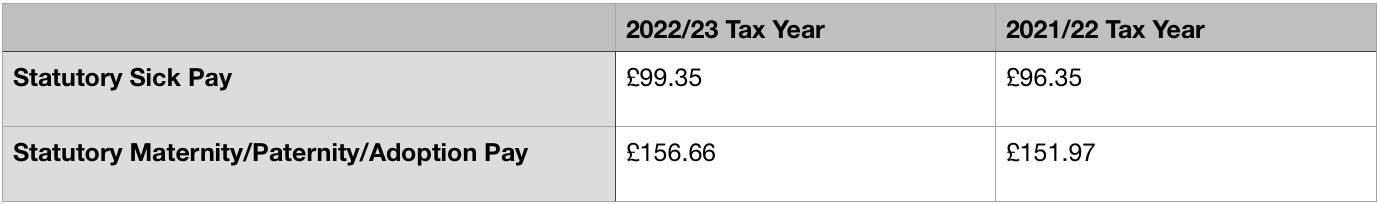

Statutory Payments

There have been increases in statutory sick pay and maternity/paternity/adoption pay in the UK 2022/23 tax year.

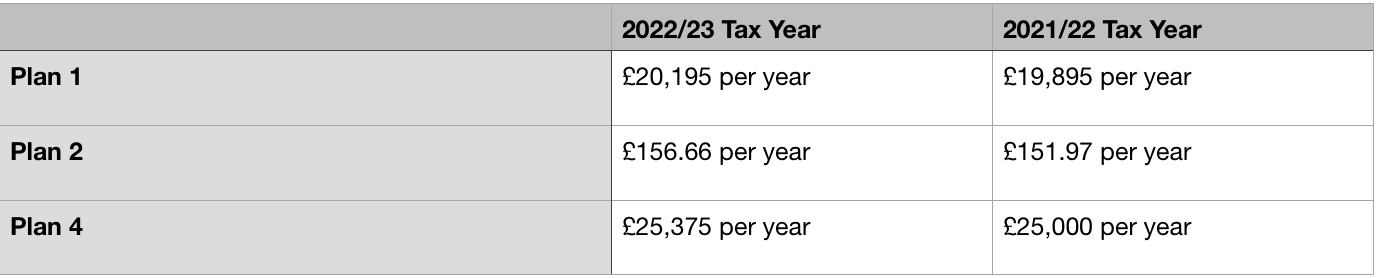

Student Loan Thresholds

The minimum earnings at which employees in the UK pay back their student loan plans has changed for repayment plans 1 and 4. The repayment rate has remained the same at 9% of all earnings above the threshold.

Not sure which plan you or an employee is on? See the criteria for repayment plans.

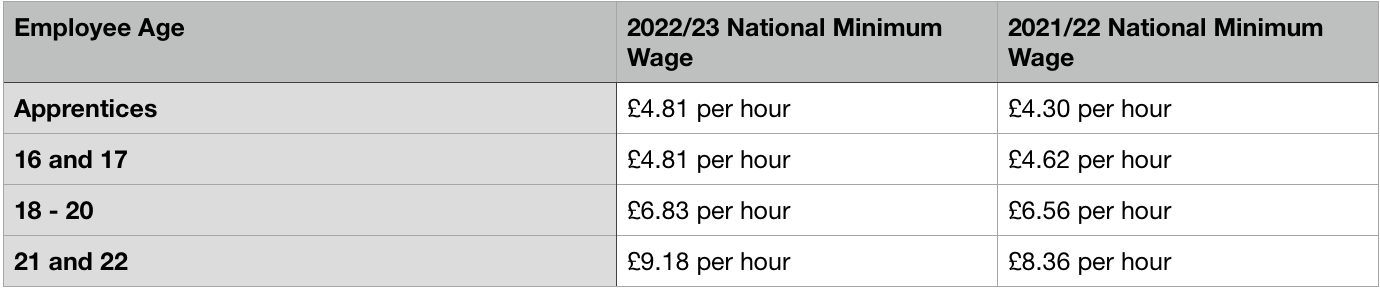

National Minimum Wage Hourly Rates

The National Living Wage (NLW) has risen from £8.91 in 2021/22 to £9.50 in 2022/23. The age threshold has also changed from 25+, to 23+.

Trusted with over 250,000 payments per month, Finesse Resources are a team of highly skilled and experienced payroll professionals. If you would like to find out more about our services, get in touch on 03303 201 924 or contact us using this form.