Mid-Year Payroll Changes: Strategies for Success

Mid-year changes can often feel like disruptions to the usual smooth process of payroll. From salary adjustments and benefit modifications to changes in pay schedules and new software, these changes can impact everything from background processes right through to employee paychecks. However, with the right approach, businesses can implement these changes effectively. Learn about the two types of payroll changes and how to approach each one with this quick guide from Finesse Resources.

Understanding mid-year payroll changes

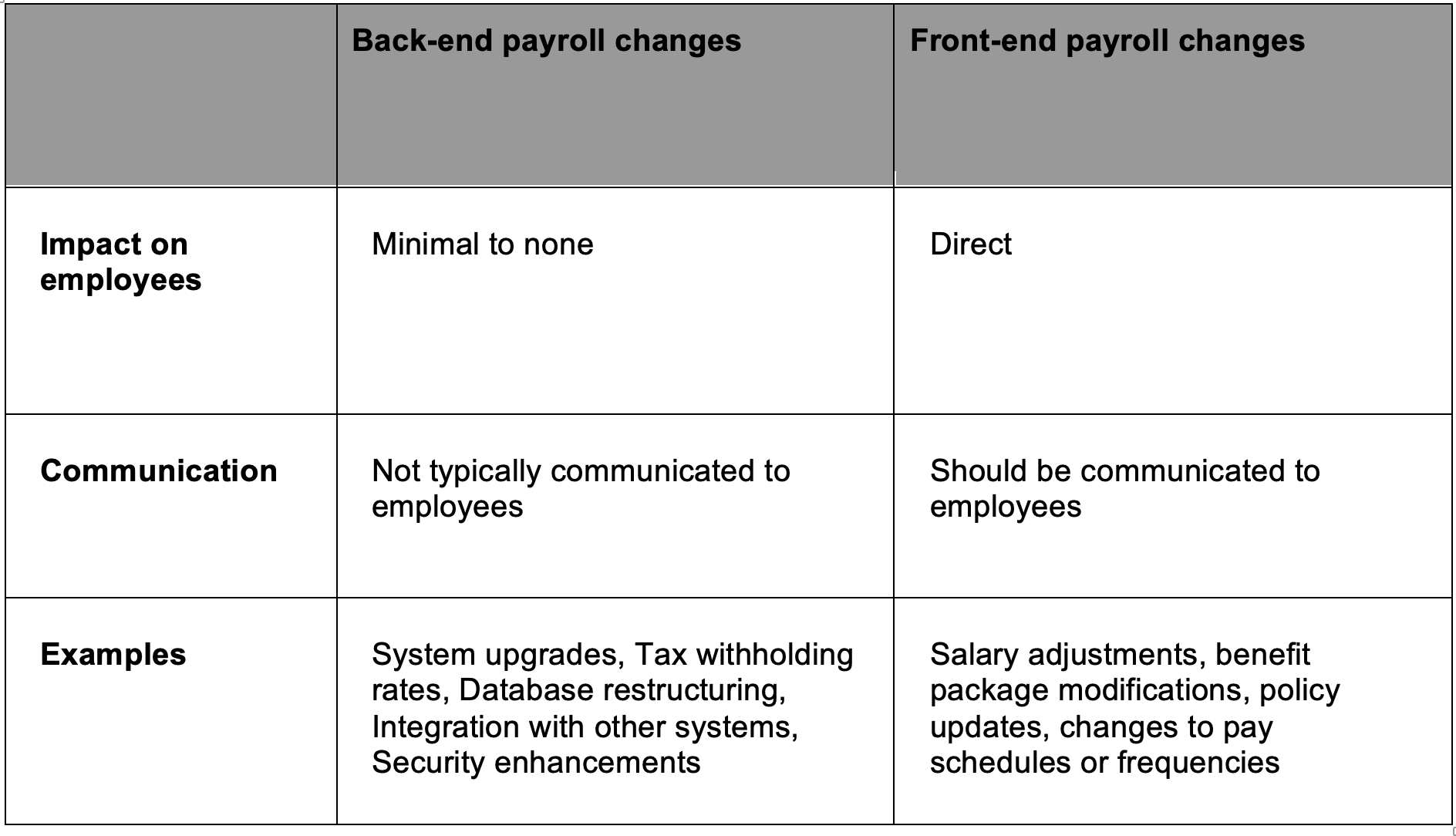

Mid-year payroll changes encompass a wide range of modifications. Some changes can be made without the need to notify employees. We call these ‘back-end changes’. Other changes should be carried out in a manner that keeps employees informed and allays any concerns they might have. These are called ‘front-end’ changes. The strategy for successfully carrying out changes is different for front and back-end changes, so it’s important to consider which type of change you’re looking to make.

Here is a table that summarises the key differences between back-end and front-end payroll changes:

How to implement mid-year back-end payroll changes

Back-end changes typically occur behind the scenes and do not directly impact employees' payslips or benefits. However, they may affect the accuracy and efficiency of payroll processing, so it’s important to make sure they are carried out seamlessly.

Payroll teams can effectively carry out back-end changes by following these guidelines:

- Planning and preparation: Before implementing any changes, payroll teams should carefully plan and prepare. This involves understanding the change, assessing its impact and developing a detailed implementation plan.

- Communication with stakeholders: Payroll teams should communicate with relevant business stakeholders, such as HR, IT and finance departments, to ensure everyone is aware of the changes and their potential impact.

- Testing and validation: Once the changes are implemented, payroll teams should thoroughly test the new system or procedures to ensure they are functioning correctly. This may involve running A/B tests and validating calculations.

- Monitoring and documentation: Payroll teams should monitor the changes after implementation to identify any issues and make necessary adjustments. They should also document the changes and the implementation process for future reference.

How to implement mid-year front-end payroll changes

Front-end changes have a direct impact on employees' payslips, benefits and payroll experience, so changes should be communicated to them in a timely and clear manner. Doing so will help minimise concerns and alleviate potential issues before they arise.

Here’s how payroll teams can successfully carry out front-end changes:

- Communication with employees: Payroll teams should communicate front-end payroll changes to employees in a timely and clear manner. This includes explaining the changes, their effective date, and any potential impact on employees' payslips or benefits.

- Update employee records: Payroll teams should update employee records to reflect the changes. This may involve updating salaries, benefits, or deductions.

- Review and reconciliation: Payroll teams should review and reconcile payslips and benefits statements after the changes are implemented to ensure they are accurate.

- Address employee concerns: Payroll teams should be prepared to address any questions or concerns from employees about the changes. This may involve providing additional information or explaining the rationale for the changes. Always allow enough time between announcing a change and making it so that employees can have their questions answered.

- Get feedback: If you are making a change to improve the payroll experience for an employee, ask them for feedback on the change and how it was carried out. This may help you streamline the process next time.

In addition to these guidelines, payroll teams can also use the following strategies to carry out changes effectively:

- Use technology: Technology can automate many payroll tasks, freeing up payroll teams to focus on more complex changes.

- Stay up-to-date on regulations: Payroll teams should stay up-to-date on changes to payroll regulations to ensure they are compliant.

- Seek professional guidance: Payroll teams can consult with payroll experts like Finesse Resources for guidance on implementing complex changes mid-way through a tax year.